An illegal agreement under the common law of contract, is one that the court will not enforce because the purpose of the agreement is to achieve an illegal end. The illegal end must result from performance of the contract itself. The classic example of such an agreement is a contract for murder.

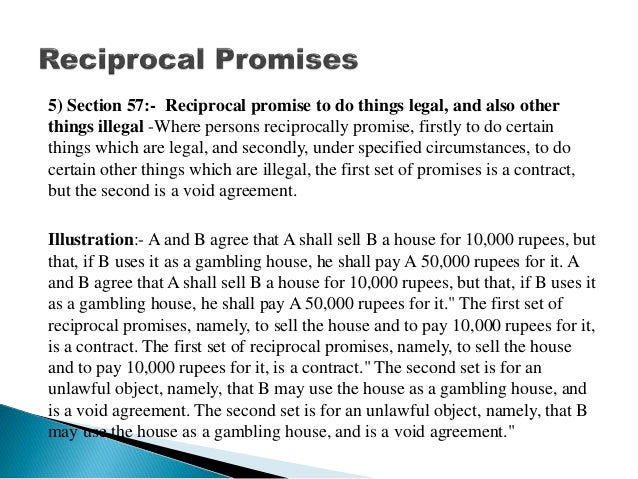

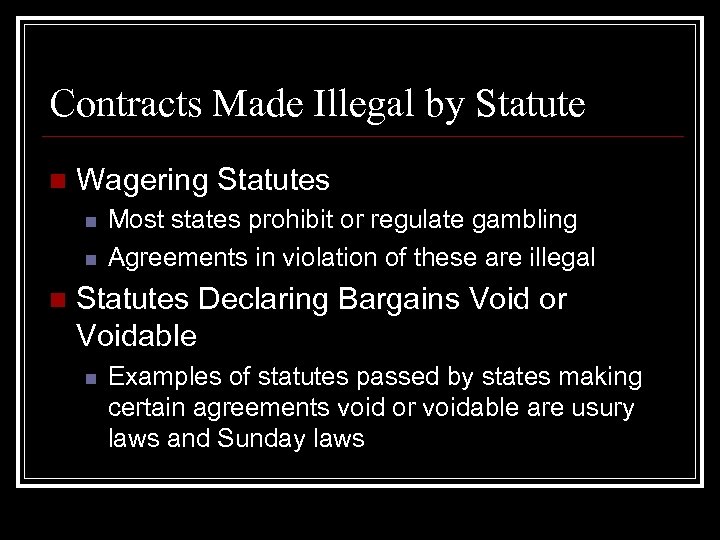

Apr 01, 2015 Sam refused to pay his debt, saying the gambling contract is void. The contract is illegal and void. The contract is enforceable. The contract is enforceable. Suppose that Lennie lawyer enters into an agreement with Cindy client that his fee will be a percentage of the recovery Lenny obtains for Cindy in her pending divorce. Why is betting on Horse Racing legal in India? Horse racing is one of the sports in which gambling is very prominent. It is not something which is illegal in India. Its legality has been challenged before the courts as well and the Supreme Court held it to be legal. A distinction is taken between contracts illegal in character and contracts merely unenforceable as being against public policy - for instance, gambling agreements and agreements in restraint of trade. The one is absolutely illegal, the other is illegal only in the sense it is unenforceable on account of.

However, a contract that requires only legal performance on the part of each party, such as the sale of packs of cards to a known gambler, where gambling is illegal, will nonetheless be enforceable. A contract directly linked to the gambling act itself, such as paying off gambling debts (see proximate cause), however, will not meet the legal standards of enforceability. Therefore, an employment contract between a blackjackdealer and a speakeasy manager, is an example of an illegal agreement and the employee has no valid claim to his anticipated wages if gambling is illegal under that jurisdiction.

In Bovard v. American Horse Enterprises (1988),[1] the California Court of Appeal for the Third District refused to enforce a contract for payment of promissory notes used for the purchase of a company that manufactured drug paraphernalia. Although the items sold were not actually illegal, the court refused to enforce the contract for public policy concerns.

In Canada, one cited case of lack of enforceability based on illegality is Royal Bank of Canada v. Newell, 147 D.L.R (4th) 268 (N.S.C.A.), in which a woman forged her husband's signature on 40 cheques, totalling over $58,000. To protect her from prosecution, her husband signed a letter of intent prepared by the bank in which he agreed to assume 'all liability and responsibility' for the forged cheques. However, the agreement was unenforceable, and was struck down by the courts, because of its essential goal, which was to 'stifle a criminal prosecution'. Because of the contract's illegality, and as a result voided status, the bank was forced to return the payments made by the husband.

Contracts in restraint of trade are a variety of illegal contracts and generally will not be enforced unless they are reasonable in the interests of the contracting parties and the public.

Contracts in restraint of trade if proved to be reasonable can be enforced. When restraint is placed on an ex-employee, the court will consider the geographical limits, what the employee knows and the extent of the duration. Restraint imposed on a vendor of business must be reasonable and is binding if there is a genuine seal of goodwill. Under common law, contracts to fix prices are legal. Sole supplier ('solus') agreements are legal if reasonable. Contracts which contravene public policy are void.

See also[edit]

References[edit]

- ^Bovard v. American Horse Enterprises, 201 Cal. App. 3d 832, 247 Cal. Rptr. 340 (1988).

The history of gambling in Illinois dates back to 1920s when the state legalized betting on horse races held at local racetracks. In 1990, the Riverboat Gambling Act made it legal to run commercial casinos as long as they were located on boats operating outside Lake Michigan and counties with populations in excess of three million people. The next landmark piece of legislation was passed in 2009 when local bars and other similar venues were allowed to host lottery terminals operated by the Illinois Lottery. No further gambling laws have been passed since then, which means that Illinois doesn’t have a regulated iGaming market.

There’s a significant push to legalize online gambling and expand land-based gambling with bill SB-0007, which was introduced in 2017. The bill is sponsored by Sen. Terry Link, Dave Syverson, Mattie Hunter, and Donne E. Trotter in the Senate and Rep. Robert Rita, Rita Mayfield, Chad Hays, and Litesa E. Wallace in the House. The proceedings are very slow, and there’s significant opposition from the local casinos, so it’s impossible to make any predictions regarding specific provisions or the final shape of the bill. The last action on the bill occurred in May 2018 when the House re-referred it to the Rules Committee.

Illinois law defines gambling as “playing games of chance or skill for money or other thing of value,” which leaves very little wiggle room for creative interpretation. Some people believe that playing on offshore sites shouldn’t be considered unlawful because the issue of online gambling hasn’t been addressed directly. Unfortunately, the local authorities don’t seem to share this point of view – Illinois Attorney General Lisa Madigan, who classified DFS contests as illegal gambling in 2015.

Gambling in Illinois is covered by Illinois Compiled Statutes, sec. 720 5/28-1 et seq.; 230 10/1 et seq.; 230 5/1 et seq. The minimum gambling age is 18 for lottery and horse race betting and 21 for casino-style games. Engaging in unlawful gambling is a class A misdemeanor.

Illinois Compiled Statutes

Sec. 5-2. When accountability exists.

A person is legally accountable for the conduct of another when:

(a) having a mental state described by the statute defining the offense, he or she causes another to perform the conduct, and the other person in fact or by reason of legal incapacity lacks such a mental state;

(b) the statute defining the offense makes him or her so accountable; or

(c) either before or during the commission of an offense, and with the intent to promote or facilitate that commission, he or she solicits, aids, abets, agrees, or attempts to aid that other person in the planning or commission of the offense.

When 2 or more persons engage in a common criminal design or agreement, any acts in the furtherance of that common design committed by one party are considered to be the acts of all parties to the common design or agreement and all are equally responsible for the consequences of those further acts. Mere presence at the scene of a crime does not render a person accountable for an offense; a person’s presence at the scene of a crime, however, may be considered with other circumstances by the trier of fact when determining accountability.

A person is not so accountable, however, unless the statute defining the offense provides otherwise, if:

(1) he or she is a victim of the offense committed; (2) the offense is so defined that his or her conduct was inevitably incident to its commission; or

(3) before the commission of the offense, he or she terminates his or her effort to promote or facilitate that commission and does one of the following: (i) wholly deprives his or her prior efforts of effectiveness in that commission, (ii) gives timely warning to the proper law enforcement authorities, or (iii) otherwise makes proper effort to prevent the commission of the offense.

CRIMINAL OFFENSES

ARTICLE 28. GAMBLING AND RELATED OFFENSES

720 ILCS 5/28-1) (from Ch. 38, par. 28-1)

Is Gambling Illegal In Va

Sec. 28-1. Gambling.

- (a) A person commits gambling when he or she:

- (1) knowingly plays a game of chance or skill for money or other thing of value, unless excepted in subsection (b) of this Section;

- (2) knowingly makes a wager upon the result of any game, contest, or any political nomination, appointment or election;

- (3) knowingly operates, keeps, owns, uses, purchases, exhibits, rents, sells, bargains for the sale or lease of, manufactures or distributes any gambling device;

- (4) contracts to have or give himself or herself or another the option to buy or sell, or contracts to buy or sell, at a future time, any grain or other commodity whatsoever, or any stock or security of any company, where it is at the time of making such contract intended by both parties thereto that the contract to buy or sell, or the option, whenever exercised, or the contract resulting therefrom, shall be settled, not by the receipt or delivery of such property, but by the payment only of differences in prices thereof; however, the issuance, purchase, sale, exercise, endorsement or guarantee, by or through a person registered with the Secretary of State pursuant to Section 8 of the Illinois Securities Law of 1953 [815 ILCS 5/8], or by or through a person exempt from such registration under said Section 8, of a put, call, or other option to buy or sell securities which have been registered with the Secretary of State or which are exempt from such registration under Section 3 of the Illinois Securities Law of 1953 [815 ILCS 5/3] is not gambling within the meaning of this paragraph (4);

- (5) knowingly owns or possesses any book, instrument or apparatus by means of which bets or wagers have been, or are, recorded or registered, or knowingly possesses any money which he has received in the course of a bet or wager;

- (6) knowingly sells pools upon the result of any game or contest of skill or chance, political nomination, appointment or election;

- (7) knowingly sets up or promotes any lottery or sells, offers to sell or transfers any ticket or share for any lottery;

- (8) knowingly sets up or promotes any policy game or sells, offers to sell or knowingly possesses or transfers any policy ticket, slip, record, document or other similar device;

- (9) knowingly drafts, prints or publishes any lottery ticket or share, or any policy ticket, slip, record, document or similar device, except for such activity related to lotteries, bingo games and raffles authorized by and conducted in accordance with the laws of Illinois or any other state or foreign government;

- (10) knowingly advertises any lottery or policy game, except for such activity related to lotteries, bingo games and raffles authorized by and conducted in accordance with the laws of Illinois or any other state;

- (11) knowingly transmits information as to wagers, betting odds, or changes in betting odds by telephone, telegraph, radio, semaphore or similar means; or knowingly installs or maintains equipment for the transmission or receipt of such information; except that nothing in this subdivision (11) prohibits transmission or receipt of such information for use in news reporting of sporting events or contests; or

- (12) knowingly establishes, maintains, or operates an Internet site that permits a person to play a game of chance or skill for money or other thing of value by means of the Internet or to make a wager upon the result of any game, contest, political nomination, appointment, or election by means of the Internet. This item (12) does not apply to activities referenced in items (6) and (6.1) of subsection (b) of this Section.

- (b) Participants in any of the following activities shall not be convicted of gambling:

- (1) Agreements to compensate for loss caused by the happening of chance including without limitation contracts of indemnity or guaranty and life or health or accident insurance.

- (2) Offers of prizes, award or compensation to the actual contestants in any bona fide contest for the determination of skill, speed, strength or endurance or to the owners of animals or vehicles entered in such contest.

- (3) Pari-mutuel betting as authorized by the law of this State.

- (4) Manufacture of gambling devices, including the acquisition of essential parts therefor and the assembly thereof, for transportation in interstate or foreign commerce to any place outside this State when such transportation is not prohibited by any applicable Federal law; or the manufacture, distribution, or possession of video gaming terminals, as defined in the Video Gaming Act [230 ILCS 40/1 et seq.], by manufacturers, distributors, and terminal operators licensed to do so under the Video Gaming Act.

- (5) The game commonly known as “bingo”, when conducted in accordance with the Bingo License and Tax Act [230 ILCS 25/1 et seq.].

- (6) Lotteries when conducted by the State of Illinois in accordance with the Illinois Lottery Law [20 ILCS 1605/1 et seq.]. This exemption includes any activity conducted by the Department of Revenue to sell lottery tickets pursuant to the provisions of the Illinois Lottery Law and its rules.

- (6.1) The purchase of lottery tickets through the Internet for a lottery conducted by the State of Illinois under the program established in Section 7.12 of the Illinois Lottery Law [20 ILCS 1605/7.12].

- (7) Possession of an antique slot machine that is neither used nor intended to be used in the operation or promotion of any unlawful gambling activity or enterprise. For the purpose of this subparagraph (b)(7), an antique slot machine is one manufactured 25 years ago or earlier.

- (8) Raffles and poker runs when conducted in accordance with the Raffles and Poker Runs Act [230 ILCS 15/1 et seq.].

- (9) Charitable games when conducted in accordance with the Charitable Games Act [230 ILCS 30/1 et seq.].

- (10) Pull tabs and jar games when conducted under the Illinois Pull Tabs and Jar Games Act [230 ILCS 20/1 et seq.].

- (11) Gambling games conducted on riverboats when authorized by the Riverboat Gambling Act [230 ILCS 10/1 et seq.].

- (12) Video gaming terminal games at a licensed establishment, licensed truck stop establishment, licensed fraternal establishment, or licensed veterans establishment when conducted in accordance with the Video Gaming Act.

- (13) Games of skill or chance where money or other things of value can be won but no payment or purchase is required to participate.

- (14) Savings promotion raffles authorized under Section 5g of the Illinois Banking Act [205 ILCS 5/5g], Section 7008 of the Savings Bank Act [205 ILCS 205/7008], Section 42.7 of the Illinois Credit Union Act [205 ILCS 305/42.7], Section 5136B of the National Bank Act (12 U.S.C. 25a), or Section 4 of the Home Owners’ Loan Act (12 U.S.C. 1463).

- (c) Sentence.

- Gambling is a Class A misdemeanor. A second or subsequent conviction under subsections (a)(3) through (a)(12), is a Class 4 felony.

- (d) Circumstantial evidence.

What Is Illegal Internet Gambling

- In prosecutions under this Section circumstantial evidence shall have the same validity and weight as in any criminal prosecution.

(720 ILCS 5/28‑2) (from Ch. 38, par. 28‑2)

Sec. 28‑2. Definitions.

- (a) A “gambling device” is any clock, tape machine, slot machine or other machines or device for the reception of money or other thing of value on chance or skill or upon the action of which money or other thing of value is staked, hazarded, bet, won or lost; or any mechanism, furniture, fixture, equipment or other device designed primarily for use in a gambling place. A “gambling device” does not include:

- (1) A coin-in-the-slot operated mechanical device played for amusement which rewards the player with the right to replay such mechanical device, which device is so constructed or devised as to make such result of the operation thereof depend in part upon the skill of the player and which returns to the player thereof no money, property or right to receive money or property.

- (2) Vending machines by which full and adequate return is made for the money invested and in which there is no element of chance or hazard.

- (3) A crane game. For the purposes of this paragraph (3), a “crane game” is an amusement device involving skill, if it rewards the player exclusively with merchandise contained within the amusement device proper and limited to toys, novelties and prizes other than currency, each having a wholesale value which is not more than $25.

- (4) A redemption machine. For the purposes of this paragraph (4), a “redemption machine” is a single-player or multi-player amusement device involving a game, the object of which is throwing, rolling, bowling, shooting, placing, or propelling a ball or other object that is either physical or computer generated on a display or with lights into, upon, or against a hole or other target that is either physical or computer generated on a display or with lights, or stopping, by physical, mechanical, or electronic means, a moving object that is either physical or computer generated on a display or with lights into, upon, or against a hole or other target that is either physical or computer generated on a display or with lights, provided that all of the following conditions are met:

- (A) The outcome of the game is predominantly determined by the skill of the player.

- (B) The award of the prize is based solely upon the player’s achieving the object of the game or otherwise upon the player’s score.

- (C) Only merchandise prizes are awarded.

- (D) The wholesale value of prizes awarded in lieu of tickets or tokens for single play of the device does not exceed $25.

- (E) The redemption value of tickets, tokens, and other representations of value, which may be accumulated by players to redeem prizes of greater value, for a single play of the device does not exceed $25.

- (5) Video gaming terminals at a licensed establishment, licensed truck stop establishment, licensed fraternal establishment, or licensed veterans establishment licensed in accordance with the Video Gaming Act [230 ILCS 40/1 et seq.].

- (a-5) “Internet” means an interactive computer service or system or an information service, system, or access software provider that provides or enables computer access by multiple users to a computer server, and includes, but is not limited to, an information service, system, or access software provider that provides access to a network system commonly known as the Internet, or any comparable system or service and also includes, but is not limited to, a World Wide Web page, newsgroup, message board, mailing list, or chat area on any interactive computer service or system or other online service.

- (a-6) “Access” and “computer” have the meanings ascribed to them in Section 16D-2 of this Code [720 ILCS 5/16D-2 (now repealed)].

- (b) A “lottery” is any scheme or procedure whereby one or more prizes are distributed by chance among persons who have paid or promised consideration for a chance to win such prizes, whether such scheme or procedure is called a lottery, raffle, gift, sale or some other name, excluding savings promotion raffles authorized under Section 5g of the Illinois Banking Act, Section 7008 of the Savings Bank Act [205 ILCS 205/7008], Section 42.7 of the Illinois Credit Union Act [205 ILCS 305/42.7], Section 5136B of the National Bank Act (12 U.S.C. 25a), or Section 4 of the Home Owners’ Loan Act (12 U.S.C. 1463).

- (c) A “policy game” is any scheme or procedure whereby a person promises or guarantees by any instrument, bill, certificate, writing, token or other device that any particular number, character, ticket or certificate shall in the event of any contingency in the nature of a lottery entitle the purchaser or holder to receive money, property or evidence of debt.

Why Is Online Gambling Illegal

(720 ILCS 5/28‑3) (from Ch. 38, par. 28‑3)

Sec. 28‑3. Keeping a Gambling Place.

A“gambling place” is any real estate, vehicle, boat or any other property whatsoever used for the purposes of gambling other than gambling conducted in the manner authorized by the Riverboat Gambling Act [230 ILCS 10/1 et seq.] or the Video Gaming Act [230 ICLS 40/1 et seq] . Any person who knowingly permits any premises or property owned or occupied by him or under his control to be used as a gambling place commits a Class A misdemeanor. Each subsequent offense is a Class 4 felony. When any premises is determined by the circuit court to be a gambling place:

(a) Such premises is a public nuisance and may be proceeded against as such, and

(b) All licenses, permits or certificates issued by the State of Illinois or any subdivision or public agency thereof authorizing the serving of food or liquor on such premises shall be void; and no license, permit or certificate so cancelled shall be reissued for such premises for a period of 60 days thereafter; nor shall any person convicted of keeping a gambling place be reissued such license for one year from his conviction and, after a second conviction of keeping a gambling place, any such person shall not be reissued such license, and

(c) Such premises of any person who knowingly permits thereon a violation of any Section of this Article shall be held liable for, and may be sold to pay any unsatisfied judgment that may be recovered and any unsatisfied fine that may be levied under any Section of this Article.

(Source: P.A. 86‑1029.)

(720 ILCS 5/28‑4) (from Ch. 38, par. 28‑4)

Sec. 28‑4. Registration of Federal Gambling Stamps.

(a) Every person who has purchased a Federal Wagering Occupational Tax Stamp, as required by the United States under the applicable provisions of the Internal Revenue Code, or a Federal Gaming Device Tax Stamp, as required by the United States under the applicable provisions of the Internal Revenue Code, shall register forthwith such stamp or stamps with the county clerk’s office in which he resides and the county clerk’s office of each and every county in which he conducts any business. A violation of this Section is a Class B misdemeanor. A subsequent violation is a Class A misdemeanor.

(b) To register a stamp as required by this Section, each individual stamp purchaser and each member of a firm or association which is a stamp purchaser and, if such purchaser is corporate, the registered agent of the purchasing corporation shall deliver the stamp to the county clerk for inspection and shall under oath or affirmation complete and sign a registration form which shall state the full name and residence and business address of each purchaser and of each member of a purchasing firm or association and of each person employed or engaged in gambling on behalf of such purchaser, shall state the registered agent and registered address of a corporate purchaser, shall state each place where gambling is to be performed by or on behalf of the purchaser, and shall state the duration of validity of the stamp and the federal registration number and tax return number thereof. Any false statement in the registration form is material and is evidence of perjury.

(c) Within 3 days after such registration the county clerk shall by registered mail forward notice of such registration and a duplicate copy of each registration form to the Attorney General of this State, to the Chairman of the Illinois Liquor Control Commission, to the State’s Attorney and Sheriff of each county wherein the stamp is registered, and to the principal official of the department of police of each city, village and incorporated town in this State wherein the stamp is registered or wherein the registrant maintains a business address.

(Source: P. A. 77‑2638.)

(720 ILCS 5/28‑5) (from Ch. 38, par. 28‑5)

Sec. 28‑5. Seizure of gambling devices and gambling funds.

(a) Every device designed for gambling which is incapable of lawful use or every device used unlawfully for gambling shall be considered a “gambling device” , and shall be subject to seizure, confiscation and destruction by the Department of State Police or by any municipal, or other local authority, within whose jurisdiction the same may be found. As used in this Section, a “gambling device” includes any slot machine, and includes any machine or device constructed for the reception of money or other thing of value and so constructed as to return, or to cause someone to return, on chance to the player thereof money, property or a right to receive money or property. With the exception of any device designed for gambling which is incapable of lawful use, no gambling device shall be forfeited or destroyed unless an individual with a property interest in said device knows of the unlawful use of the device.

(b) Every gambling device shall be seized and forfeited to the county wherein such seizure occurs. Any money or other thing of value integrally related to acts of gambling shall be seized and forfeited to the county wherein such seizure occurs.

A Gambling Agreement Is Illegal And Void Free

(c) If, within 60 days after any seizure pursuant to subparagraph (b) of this Section, a person having any property interest in the seized property is charged with an offense, the court which renders judgment upon such charge shall, within 30 days after such judgment, conduct a forfeiture hearing to determine whether such property was a gambling device at the time of seizure. Such hearing shall be commenced by a written petition by the State, including material allegations of fact, the name and address of every person determined by the State to have any property interest in the seized property, a representation that written notice of the date, time and place of such hearing has been mailed to every such person by certified mail at least 10 days before such date, and a request for forfeiture. Every such person may appear as a party and present evidence at such hearing. The quantum of proof required shall be a preponderance of the evidence, and the burden of proof shall be on the State. If the court determines that the seized property was a gambling device at the time of seizure, an order of forfeiture and disposition of the seized property shall be entered: a gambling device shall be received by the State’s Attorney, who shall effect its destruction, except that valuable parts thereof may be liquidated and the resultant money shall be deposited in the general fund of the county wherein such seizure occurred; money and other things of value shall be received by the State’s Attorney and, upon liquidation, shall be deposited in the general fund of the county wherein such seizure occurred. However, in the event that a defendant raises the defense that the seized slot machine is an antique slot machine described in subparagraph (b) (7) of Section 28‑1 of this Code and therefore he is exempt from the charge of a gambling activity participant, the seized antique slot machine shall not be destroyed or otherwise altered until a final determination is made by the Court as to whether it is such an antique slot machine. Upon a final determination by the Court of this question in favor of the defendant, such slot machine shall be immediately returned to the defendant. Such order of forfeiture and disposition shall, for the purposes of appeal, be a final order and judgment in a civil proceeding.

(d) If a seizure pursuant to subparagraph (b) of this Section is not followed by a charge pursuant to subparagraph (c) of this Section, or if the prosecution of such charge is permanently terminated or indefinitely discontinued without any judgment of conviction or acquittal (1) the State’s Attorney shall commence an in rem proceeding for the forfeiture and destruction of a gambling device, or for the forfeiture and deposit in the general fund of the county of any seized money or other things of value, or both, in the circuit court and (2) any person having any property interest in such seized gambling device, money or other thing of value may commence separate civil proceedings in the manner provided by law.

(e) Any gambling device displayed for sale to a riverboat gambling operation or used to train occupational licensees of a riverboat gambling operation as authorized under the Riverboat Gambling Act is exempt from seizure under this Section.

(f) Any gambling equipment, devices and supplies provided by a licensed supplier in accordance with the Riverboat Gambling Act which are removed from the riverboat for repair are exempt from seizure under this Section.

(Source: P.A. 87‑826.)

(720 ILCS 5/28‑7) (from Ch. 38, par. 28‑7)

Sec. 28‑7. Gambling contracts void.

(a) All promises, notes, bills, bonds, covenants, contracts, agreements, judgments, mortgages, or other securities or conveyances made, given, granted, drawn, or entered into, or executed by any person whatsoever, where the whole or any part of the consideration thereof is for any money or thing of value, won or obtained in violation of any Section of this Article are null and void.

(b) Any obligation void under this Section may be set aside and vacated by any court of competent jurisdiction, upon a complaint filed for that purpose, by the person so granting, giving, entering into, or executing the same, or by his executors or administrators, or by any creditor, heir, legatee, purchaser or other person interested therein; or if a judgment, the same may be set aside on motion of any person stated above, on due notice thereof given.

(c) No assignment of any obligation void under this Section may in any manner affect the defense of the person giving, granting, drawing, entering into or executing such obligation, or the remedies of any person interested therein.

(d) This Section shall not prevent a licensed owner of a riverboat gambling operation from instituting a cause of action to collect any amount due and owing under an extension of credit to a riverboat gambling patron as authorized under the Riverboat Gambling Act.

(Source: P.A. 87‑826.)

(720 ILCS 5/28‑8) (from Ch. 38, par. 28‑8)

Sec. 28‑8. Gambling losses recoverable.

(a) Any person who by gambling shall lose to any other person, any sum of money or thing of value, amounting to the sum of $50 or more and shall pay or deliver the same or any part thereof, may sue for and recover the money or other thing of value, so lost and paid or delivered, in a civil action against the winner thereof, with costs, in the circuit court. No person who accepts from another person for transmission, and transmits, either in his own name or in the name of such other person, any order for any transaction to be made upon, or who executes any order given to him by another person, or who executes any transaction for his own account on, any regular board of trade or commercial, commodity or stock exchange, shall, under any circumstances, be deemed a “winner” of any moneys lost by such other person in or through any such transactions.

(b) If within 6 months, such person who under the terms of Subsection 28‑8(a) is entitled to initiate action to recover his losses does not in fact pursue his remedy, any person may initiate a civil action against the winner. The court or the jury, as the case may be, shall determine the amount of the loss. After such determination, the court shall enter a judgment of triple the amount so determined.

(Source: P.A. 79‑1360.)

(720 ILCS 5/28‑9) (from Ch. 38, par. 28‑9)

Sec. 28‑9.

A Gambling Agreement Is Illegal And Void Movie

At the option of the prosecuting attorney any prosecution under this Article may be commenced by an information as defined in Section 102‑12 of the Code of Criminal Procedure of 1963.

(Source: P. A. 76‑1131.)

Comments are closed.